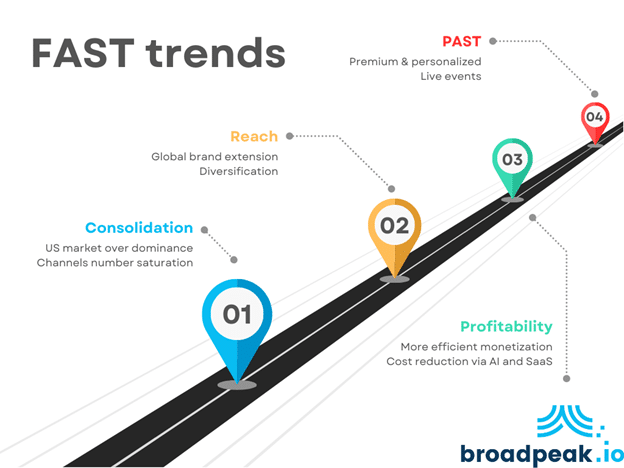

Let’s examine the evolution of the FAST channels industry and analyze possible trends for the coming years.

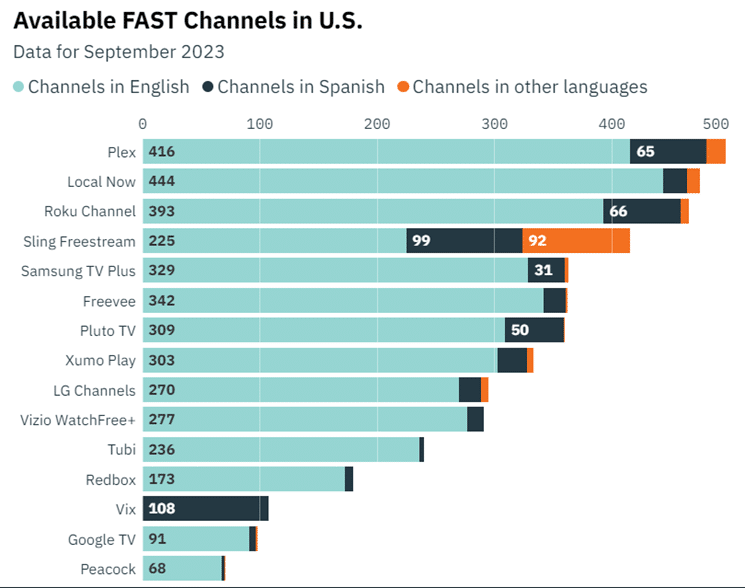

With the market still in its evolutionary stage, it’s intriguing to note that, as of today (first quarter of 2024), there are approximately 1,400 channels worldwide, including a staggering 1,050 in the United States alone, according to Gracenote’s June 2023 report. This makes it the fastest-growing streaming tier in mature markets, further buoyed by the surge in Connected TV (CTV) and Smart TV adoption. In the U.S., 47% of households engage with a FAST service weekly, a testament to its rising popularity.

A first step back

But if we look at the growth story of FAST channels is not just about numbers—it’s about changing viewer habits. It becomes clear that consumer preferences are leaning toward choice and convenience. Analyzing viewer behavior shows a clear trend: people want access to quality content without hefty price tags.

Two quick examples to illustrate this are as follows: Kantar noticed that U.S. consumers are canceling subscription services as the cost-of-living soars. On another note, research from the Hub indicates a rise in viewers turning to free, ad-supported streaming television (FAST) channels such as Paramount’s Pluto TV, with a 10% uptick observed. Now, over half of the consumers, 55%, say they receive a portion of their video content through these ad-lite platforms.

Now, have we reached the saturation point?

However, this growth spurt and the increase in the number of channels aren’t without its challenges. The distribution data shows a heavy lean toward the U.S. market, indicating a solid dominance that raises questions about market saturation. Reports from Kantar have gone as far as to say the “U.S. Streaming Market Nears Saturation,” while Nielsen has highlighted concerns about “Viewers facing content discovery challenges.”

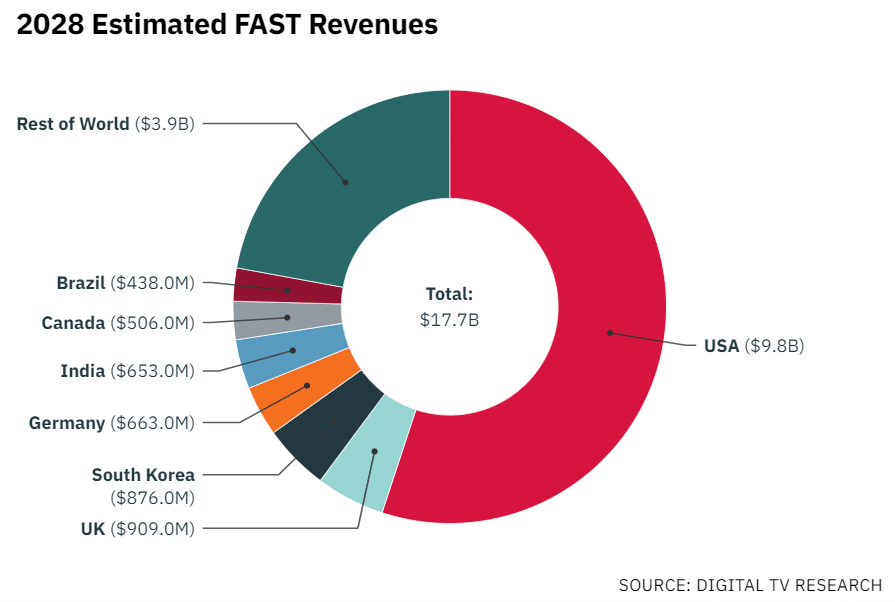

This paints a picture of a market at a critical juncture, ripe for strategic shifts to maintain momentum while building on an estimated global revenue of $B17.7:

Saturation is, therefore, already in action in the US, when other markets still have some potential to develop.

Broadening horizons: looking for global reach

The current phase in the FAST channels’ life cycle is expansion and reach. For content providers, it’s a golden opportunity to extend their brand globally, diversifying their distribution channels beyond conventional mediums. FAST has now been integrated into a comprehensive audience reach strategy that includes traditional platforms and social media, tapping into a broader, more diverse viewer base.

A good example of that is ITV, which launched 15 international FAST channels and introduced “Schitt’s Creek” as a single IP channel across 40 territories in Latin America.

For advertisers and agencies, this phase is crucial as it grants access to audiences that were previously challenging to engage through conventional TV advertising. This shift indicates a more significant trend where targeted and strategic advertising, leveraging solutions like SSAI, is becoming more prevalent.

It will be all about profitability

As the industry matures, the next phase will be characterized by a steadfast focus on profitability. This involves the introduction of more efficient ad stacks, enhanced by AI and data analytics, leading to better inventory sales, higher CPMs, and improved fill rates.

We may especially see more deals like the one between TF1PUB and Samsung TV Ads in France on Samsung TV Plus, where FAST Pure Player Platforms and Channels leverage longer, more mature customer relationships of local TV Sales Houses with Brand Advertisers and their agencies to sell their inventory instead of working from scratch.

Innovative ad unit formats are also emerging, such as overlay ads and interactive shoppable ads, transforming viewer engagement and advertising effectiveness. This will also help increase revenue and inventory filling.

Concurrently, a concerted effort will have to be made to reduce costs. This includes innovations in channel origination through virtual playout, optimization of distribution via Open Caching, and the avoidance of channel duplication. Furthermore, automated, AI-powered editorial and schedule generation advancements and automated dubbing will streamline operations and reduce overheads. These advancements in the industry are paving the way for a future where profitability is the main focus.

All in all, by leveraging AI, data analytics, and innovative ad formats, publishers can now optimize ad sales, increase revenue, and improve viewer engagement. The collaboration between TF1 and Samsung serves as a prime example of how partnerships can lead to success in the fast-growing streaming environment. With a continued emphasis on reducing costs through technological advancements, the industry is poised to enter a new era of profitability and efficiency.

The advent of premium FAST

Finally, PAST (Premium Ad-Supported TV) channels, as initially called out by Gabin Bridge in 2020 (see article), will become the norm. With PAST, high expectations become the standard, as we explained in this blog post. This category is earmarked by an array of specialized content offerings far from being niche. It emphasizes live events, including sports and news, which cater to real-time consumer interests. A good example is the MLB launching a 24/7 FAST channel in Europe via SportsTribal.

Additionally, the focus on localization, ensuring content matches audience cultures, and high Quality of Experience (QoE) are paramount.

Personalization also plays a crucial role in this phase, as tailored content becomes increasingly essential to discerning viewers. Our concept of personalized FAST channels makes a lot of sense in that context.

In Conclusion: viva la revolucion!

As we observe the trajectory of FAST channels, it is evident that they are more than just a trend—they represent a significant shift in the way content is consumed and monetized. Each phase brings challenges and opportunities, from market consolidation and saturation to the drive for global reach and profitability. The rise of PAST channels signifies a move towards a more premium and personalized streaming experience, setting new benchmarks for quality and engagement in the industry.

In any way, the abundance of exciting news and evolutions in the FAST market make it very interesting to follow and we are lucky to witness a revolution (or is it just an evolution?) of the TV industry.

In the rapidly changing TV landscape, technology is key. broadpeak.io offers innovative solutions to meet industry demands. Stay ahead with broadpeak.io‘s tech tools for optimal streaming experiences. Adapt and thrive in this entertainment revolution.