The Money Flow part 3.

In the first two parts of our Money Flow series, we explored how addressable TV is reshaping the advertising landscape. Part 1 focused on maximizing revenue through precise targeting, efficient ad management, and balancing user engagement with ad placements. Part 2 examined advancements in SSAI 2.0 and linear addressable TV, showing how these innovations personalize ads, reduce costs, and improve efficiency, with examples from France’s addressable TV approach.

In Part 3, we’ll explore the Ad Server and SSP ecosystem, offering insights into optimizing ad delivery and choosing the right partners to boost revenue in today’s dynamic market.

Decoding the Ad Servers and SSP Ecosystem

The digital advertising world is vast , with Ad Servers and Supply-Side Platforms (SSPs) at its core. These platforms play a crucial role in delivering ads across broadcasters, operators, and streaming services. Understanding the key players in this ecosystem is vital to make informed decisions on ad tech partnerships maximize revenue, and optimize ad operations.

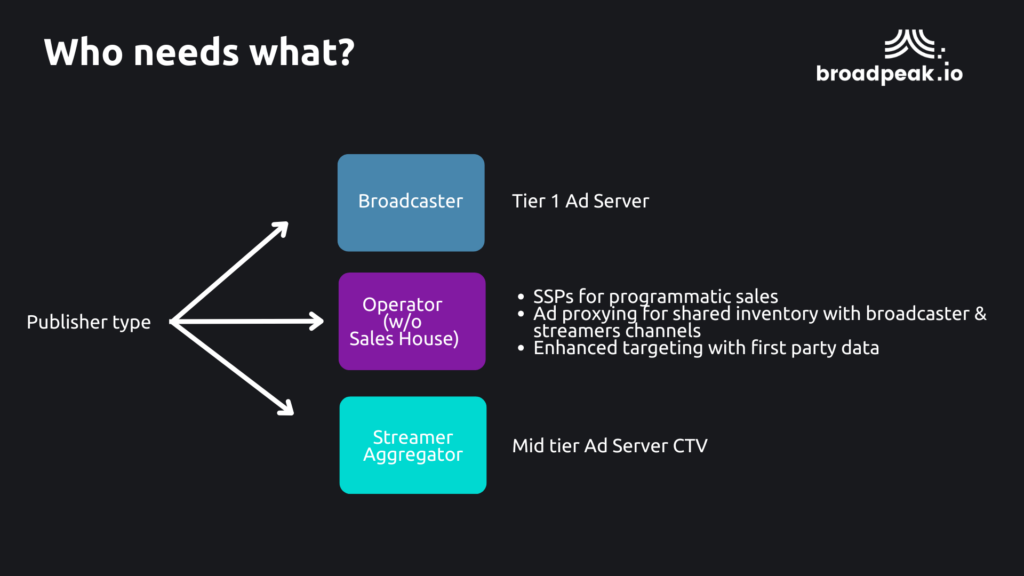

Types of Publishers and their Ad Tech Needs

Different types of publishers have specific requirements when it comes to ad servers and SSPs. Here’s a quick breakdown:

- Broadcasters typically need Tier 1 Ad Servers for high-quality, scalable ad serving that supports premium formats.

- Operators without sales houses have complementary options:

- do revenue share with broadcasters (leveraging their inventory, their ad server and their sales house), and/or,

- do programmatic ad sales of their own inventory.

In both cases, the proxy function is key to optimize ad routing and to consolidate a fragmented ecosystem.

- Streamers and aggregators often require ad servers optimized for Connected TV (CTV) environments.

The right ad technology must align with the publisher’s content delivery strategy, audience engagement, and scalability needs.

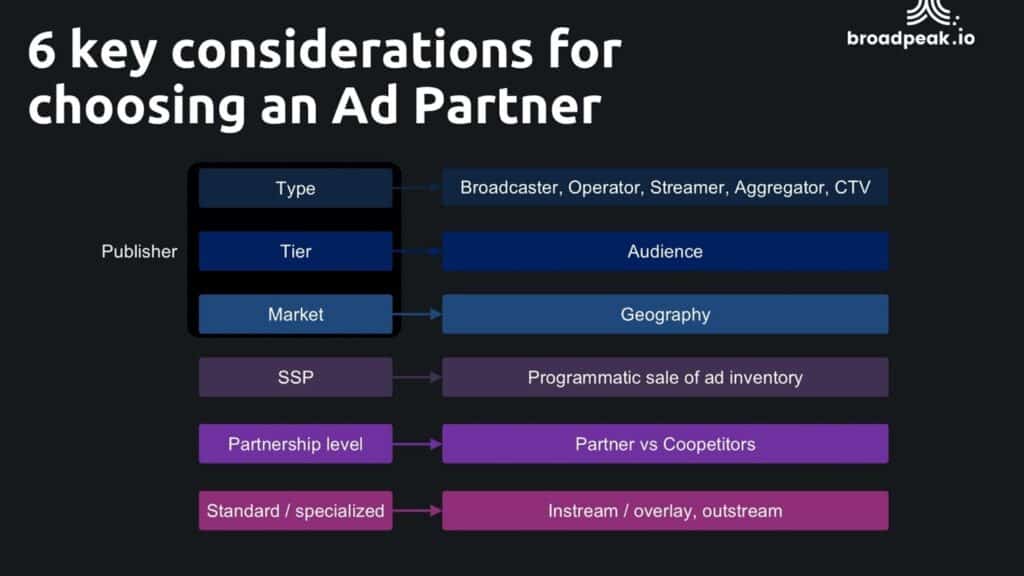

Choosing the Right Ad Tech Partner

Selecting an ad technology partner requires careful consideration of several factors:

- Type of Publisher – Whether a broadcaster, operator, or aggregator, each has distinct needs.

- Audience Scale – Larger audiences may need Tier 1 ad servers, while niche markets may do well with regional solutions.

- Market Focus – Consider geography and audience type, as global players may need more robust, multi-regional platforms.

- Programmatic Capabilities – SSPs are crucial for operators lacking direct sales teams, providing the opportunity to maximize real-time ad sales.

- Partnership Level – Assess how your partner’s goals align with yours.

- Ad Serving Solutions – Consider whether standard or specialized solutions are needed based on the content format.

By addressing these factors, publishers can effectively navigate the ad tech landscape and form successful partnerships.

Ad Servers and SSPs Ecosystem

In the digital ad ecosystem, many companies provide an Ad Server sometimes combined with an SSP dedicated to programmatic sales. Here’s a simplified breakdown:

- Tier 1 Global Solutions – Companies with comprehensive, scalable solutions for a wide range of streaming service providers.

- Regional Solutions – Players provide more localized offerings tailored to specific markets.

- Specialized Solutions – Companies offering unique formats like instream or overlay ads, meeting specialized advertising needs.

Understanding these relationships helps publishers align their ad strategies effectively.

Monetization Strategies in CTV Advertising

Creating revenue from Connected TV (CTV) advertising requires a clear grasp of the various cost structures and how different components play a role in generating profits. CTV, being a fast-evolving space, offers multiple layers of monetization opportunities.

Let’s break down the key components that make up a comprehensive end-to-end strategy, as illustrated by broadpeak.io’s approach.

1. Setup Fees

One-time fees, like the setup fee, are typical to establishing a monetization foundation. The setup fee can cover system integration, ensuring that all technology components work in sync for the operator, from ad insertion to content delivery.

2. SSAI and Ad Server Costs

Server-side ad insertion (SSAI) is key to delivering ads efficiently, especially in CTV where ad experience needs to be seamless for viewers. This SSAI + ad server charge scales with ad impressions, being volume-dependent, and fluctuates with market conditions. SSAI ensures ads are inserted at the server level, bypassing ad blockers and optimizing the ad experience for viewers.

3. SSP Revenue Share

Supply-Side Platforms (SSP) handle programmatic ad placements, connecting advertisers to available ad inventory. In CTV, SSP revenue sharing is usually between 15% and 20%, meaning a significant portion of ad revenues is claimed by the SSPs. However, this fee can decrease when operators manage their own demand rather than relying on third-party SSPs.

4. Content Delivery Network (CDN) Costs

Delivering ads and content via a content delivery network (CDN) is essential in reaching audiences efficiently. The cost for CDN delivery covers the bandwidth required for streaming both ads and content. For operators, optimizing CDN costs is vital as it directly influences profitability.

Operator-focused solution

Operators have a unique position in content monetization.

Their ability to improve targeting based upon first party data of their end users is unmatched. This goldmine is typically:

- geographic (where end users are living)

- social (household and family composition)

- contextual (what type of content is being watched, by who withing the family, with what pattern, etc…).

In order to transition to ad business models, operators have multiple challenges to overcome though. Those milestones typically include the following tasks:

- engage and negotiate with content providers (and more specifically broadcasters)

- decide whether doing revenue share (simpler) or inventory share

- decide whether being more competitive (more cost-effective plans) or diversify revenue sources (vs. subscription)

- make sure they make the best use of first party data

- make sure this data is well protected

- decide what ad tech stack (mainly ad server and SSP) to use when they have their own inventory.

This will soon be covered in a specific detailed blog post.

Role of SSAI and Ad Routing / Ad Proxy

SSAI is the backbone of this approach, enabling dynamic ad insertion and ad replacement at scale. The added benefit of an ad router allows for efficient management of ad placements, ensuring that the right ads are delivered to the right viewers without disruption. This mechanism not only bypasses ad blockers but also ensures high-quality ad experiences, a crucial factor for viewer retention in CTV.

To enhance targeting and performance, 1st-party data from publishers or advertisers is often incorporated through a Data Management Platform (DMP) or Content Management System (CMS). This data enriches the ad-routing process, providing valuable insights that drive better campaign results.

PAYG and Enterprise Business Models

broadpeak.io offers a flexible business model for CTV monetization, catering to different scales of operation:

- Free trial: for experimentation, testing, and validation purposes.

- PAYG (Pay-As-You-Go): this model supports rapid launches, allowing operators to learn and calibrate their offerings without heavy upfront investments.

- Enterprise solutions: tailored for larger operations seeking to scale efficiently, the enterprise model enables operators to reduce costs while fine-tuning their monetization strategies.

Underpinning this structure is a CPM (Cost Per Mille) model, where advertisers are charged based on inserted ads. The simplicity of this pricing model aligns with a range of operators’ needs, providing clarity in cost structures.

Comprehensive “All-In-One” Pricing Plan

broadpeak.io can also combine additional elements into a pricing plan to delivery a more streamlined solution. Publishers would benefit from an extensive toolkit including:

- Pre-connected SSPs for programmatic ad inventory sales

- Ad routing to optimize ad delivery

- Ad transcoding to ensure compatibility with various devices and formats

- Ad insertion through SSAI for seamless viewer experiences

- Ad tracking (server or client-side) to monitor performance and adjust campaigns as needed

This comprehensive approach simplifies the monetization process, ensuring all the tools required to launch and scale efficiently while managing costs.

Conclusion

Navigating the ad server and SSP ecosystem requires a good understanding of the players, market dynamics, and your business needs. Whether you’re a broadcaster, operator, or aggregator, selecting the right ad tech partners is critical for success.

By leveraging innovative solutions like broadpeak.io and integrating multiple SSPs, publishers can optimize their ad strategies, enhance user experiences, and maximize revenue potential in the ever-evolving digital advertising landscape.

In this Money Flow series, we’ve examined the rapidly evolving world of addressable TV advertising and its impact on ad strategies and revenue. We started by highlighting how addressable TV maximizes ad inventory and enhances viewer experiences (Read Part 1), then explored how SSAI 2.0 and linear addressable TV deliver more relevant ads and improve ad delivery efficiency (Read Part 2). In Part 3, we explored the ad tech ecosystem, focusing on the critical role of Ad Servers and SSPs in meeting publisher needs.

As the advertising industry changes, staying informed and adaptable is key for publishers and advertisers. Applying insights from this series helps stakeholders manage modern advertising complexities and maximize the potential of addressable TV.

For more information or to see how these strategies can support your business, contact our experts today.