Addressable TV offers a powerful solution for advertisers. Its precise targeting capabilities allow tailored messages to specific households based on demographics, geography, and behavior, leading to higher engagement and improved ROI. By focusing on specific audience segments, addressable TV reduces ad wastage and ensures more efficient spending. The platform also offers robust measurement tools and analytics for real-time tracking and optimization, making it a valuable tool for modern advertisers.

This series will explore how addressable TV influences advertising money flows and reshaping sales strategies across three critical parts. Aside from this initial discussion on inventory and money flow, we will continue with:

Pt 2: Driving Success in Addressable TV: Understanding SSAI 2.0, Linear TV, and Benefits

The second part will cover SSAI 2.0, linear addressable TV, various distribution models, and the benefits of addressable TV. We will also highlight successful examples and discuss strategies to reduce costs effectively.

Pt 3: Decoding the Ad Servers and SSP Ecosystem: A Guide for Publishers / Content Providers

In the final blog of this series, we’ll focus on the ad-serving process and the Supply-Side Platform (SSP) ecosystem, providing examples to illustrate how to choose the right ad partner for your business. By examining these facets, we aim to equip modern TV publishers with insights to maximize their transactional efficiency and impact within the advertising ecosystem.

In this first part, we will cover user experience, ad inventory, and CPM market prices, exploring their interplay with money flow. So, let’s get started!

First things first, let’s create an ad inventory while respecting the user experience of the viewers

The relationship between user experience (UX) and ad inventory is crucial in determining the optimal balance for maximizing revenue while maintaining audience engagement. As content providers seek to monetize their platforms through advertising, the question arises: how many ads can be sold and inserted before the user experience begins to deteriorate?

This blog post explores the intricacies of ad breaks and pod patterns, explaining how publishers strategically create inventory to reach their audience base. By understanding the effective ad value per impression, they can gauge the maximum limit of ads that can be sold without compromising user experience.

Furthermore, we will explore the methods of inventory selling, both through direct sales and programmatic mechanisms. In this analysis, you will understand the crucial role of ad servers and SSPs in optimizing revenue generation. Understanding their functions and capabilities is key to establishing a minimum revenue protection threshold for profitability.

Additionally, we will examine strategies to combat ad skipping, a significant challenge in the advertising ecosystem. We will explore the option of implementing client SDKs to enhance ad visibility and engagement. By addressing this issue, publishers can significantly improve their revenue generation.

What are the most important inventory metrics?

Understanding the factors defining how to create and structure ad inventory is key. These parameters, including ad breaks and ad pod patterns, duration, ad load, and ad break spacing, determine the structure and placement of ads within content. By grasping these concepts, you can optimize your ad placement and interaction, enhancing your revenue generation potential.

Audience and end-user base size are essential in understanding advertising inventory’s reach and potential impact across these ad formats. Effective ad value per impression is another critical dimension influencing ad inventory pricing and revenue generation. By considering these factors alongside ad breaks and pod patterns, publishers can strategically create and manage their inventory to maximize ad sales while ensuring a positive user experience and driving revenue growth.

How to create an inventory?

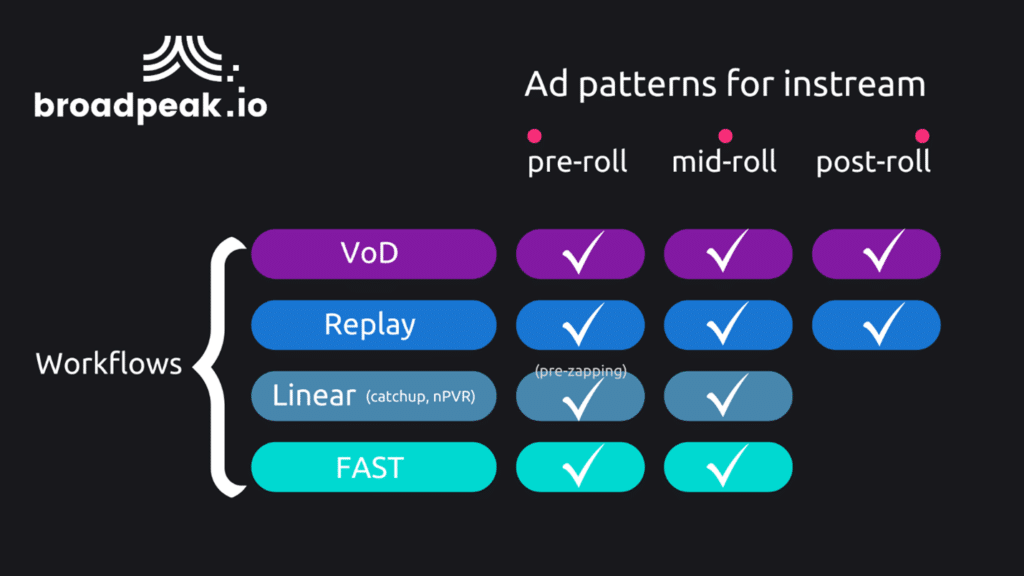

Inventory creation involves aggregating and organizing available ad spaces across different viewing platforms and content types. The workflow includes:

- Video on Demand (VoD)

- Replay options like catchup and nPVR

- Linear channels

- Startover, and

- Free Ad Supported TV (FAST)

Advertisers are given various opportunities to reach their target audience through ad placement options such as pre-, mid-, and post-roll within the content. These ad patterns allow for strategic placement of ads that align with the viewer’s content consumption behavior, ensuring maximum impact and engagement. Being able to select a specific ad position when the ad pod is built provides another opportunity to pick the most appropriate ranking within the ad break itself.

By optimizing ad placements across various inventory types and patterns, advertisers can effectively reach their desired audiences and drive desired outcomes.

How can Publishers market and advertise their ad inventory?

Advertisers need to ensure they can target viewers in the right context besides reaching the right audiences. In other words, the expectation is not just about reaching certain viewers. The need is about reaching a cohort of viewers watching the appropriate content on the right type of service, using the expected type of device, with the right ad unit format, and at the right time.

This is why having a well-defined and structured inventory is a must-have for Publishers who want to make it easy to purchase. This information is key for advertisers, DSPs, and marketplaces as it is used for every transaction to enable the buying or auction processes.

Examples of inventory definition and description can include:

- content type (genre and theme, long vs short form, format, …), especially for contextual advertising and brand safety.

- market coverage (geolocation)

- device type (CTV / Smart TV, STB, stick, Roku, Web/PC, mobile, tablet)

- inventory type (standard, sponsored, exclusive, etc.)

- ad unit formats (min and max duration, linear, non-linear, interactivity)

- ranking (position within the ad pod) and capping

- service type (live, catchup, VoD, start over, cPVR)

This metadata must always be configured and maintained up to date to ensure the sell side (Ad Server and SSP) can provision and market the ad space offering most accurately. The goal is to ensure that the buying agencies or platforms (DSPs) can easily identify and bid on the sold inventory. Ultimately, making impressions more valuable is all about making your media biddable.

Most ad servers and SSPs have online portals or specific documents to help publishers describe their inventory. Feel free to contact us if you want to see what it would look like for your inventory.

Understanding the money flow

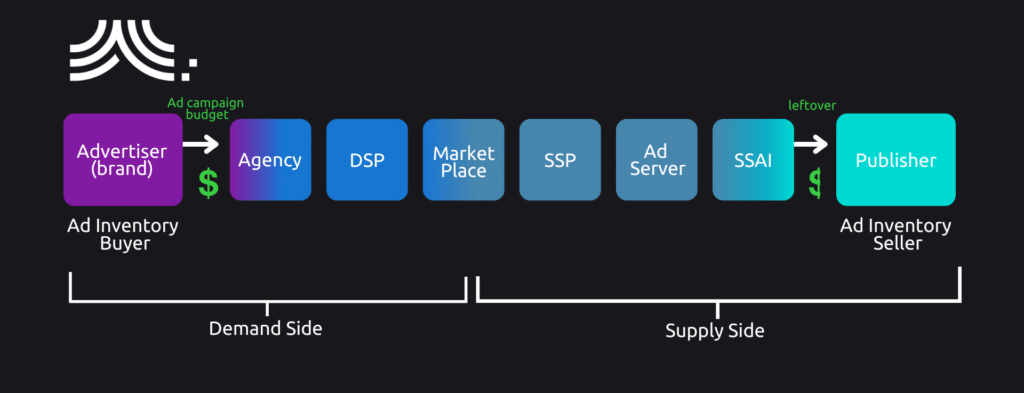

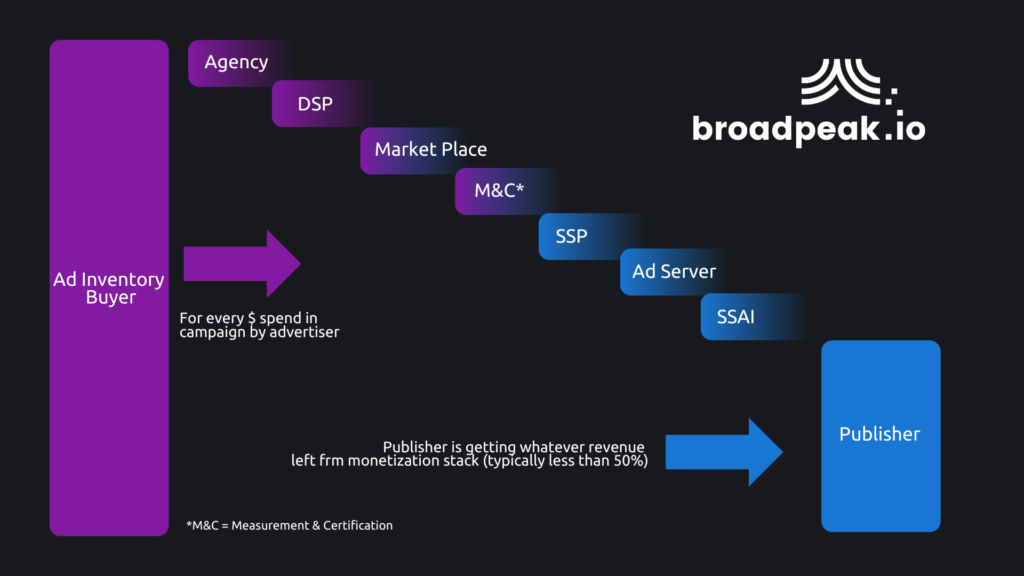

The money flow in the ad tech ecosystem is complex and multifaceted. With the proliferation of ad tech services, the ecosystem has become highly segmented and specialized. Each service, from agency to SSP to ad server, typically takes a percentage or a fixed fee per advertisement.

As the ad travels through the ecosystem, a portion of the money is taken at each step, distributing revenue among the various players.

As the industry moves towards digital advertising, the default metric for ad transactions has become CPM, or Cost per Mile. However, the value of CPM can vary depending on who is selling or buying the ad inventory.

Different players in the ecosystem have different ways of measuring and certifying ad inventory, further complicating the money flow. At the end of the chain, the publisher is left with the leftover cut as the ad inventory seller, completing the cycle from the supply side of the ecosystem.

The demand side of the ad tech ecosystem is met by advertisers, brands, and agencies looking to purchase advertising space to reach their target audience. These entities use Demand-Side Platforms (DSPs) to bid on ad inventory in real-time auctions, targeting specific audience segments and maximizing the effectiveness of their ad campaigns. The DSPs allow advertisers to bid on available ad space based on various criteria, such as audience demographics, placement, and targeting options.

Ad marketplaces and ad exchanges also play a crucial role in connecting the demand and supply sides of the ecosystem. These platforms facilitate the buying and selling of ad space in an automated and programmatic manner, ensuring that advertisers can reach their target audience efficiently and publishers can monetize their inventory effectively.

Overall, the demand side of the ecosystem is driven by the advertisers and agencies looking to reach their audience through targeted and effective advertising strategies.

What are the strategic options for publishers to maximize their revenue?

As ad tech continues to evolve, publishers face many strategy options to maximize their revenue and optimize their advertising efforts. From leveraging multiple SSPs to implementing anti-ad skipping measures, various approaches are available to publishers to enhance their monetization strategies and ensure a steady flow of revenue.

- Multi-SSP integration is a common strategy publishers adopt to maximize their fill rate and tap into multiple revenue streams. By connecting to several SSPs, publishers can optimize their ad placements and boost their ad revenue. Implementing header bidding with ad calls and managing inventory sharing are key tactics within this strategy to ensure that ad space is efficiently utilized across all platforms.

- Anti-ad skipping measures are essential for publishers looking to secure minimum revenue and prevent users from bypassing ads. In this context, and as highlighted in this blog, SSAI (Server-Side Ad Insertion) is the most efficient tool against ad blockers. In parallel, using an SDK on the client side to enforce anti-ad skipping rules and policies provides a complementary tool. By monitoring user engagement and ad viewability, publishers can ensure a more sustainable revenue stream and enhance the effectiveness of their advertising campaigns.

- Direct premium inventory sales require a dedicated Sales House and Ad Ops team to manage and sell high-value ad placements. This strategy is ideal for publishers looking to secure premium advertisers and maximize revenue from their most sought-after inventory. By leveraging direct sales, publishers can maintain control over pricing and targeting, ensuring that their premium ad space is effectively monetized.

- Programmatic: Complementary to Direct Sales (as highlighted above), programmatic advertising allows publishers to automate the sale of their ad inventory, particularly for backfill or when no in-house Sales House team is available. This strategy allows publishers to streamline the ad-selling process, reach a wider pool of advertisers, and optimize their revenue potential through real-time bidding and automation technology. Implementing programmatic advertising can help publishers monetize their ad space efficiently and capitalize on the industry’s growing demand for programmatic advertising solutions.

How can I evaluate “my CPM market price”?

The CPM market price in the ad tech industry is influenced by factors such as market country, publisher tier, device type, ad format, and the distinction between direct sales and programmatic advertising, which affects rates through automated inventory sales. Different pricing models, such as flat CPM, dynamic CPM, targeted CPM, and programmatic CPM, reflect the evolving digital advertising landscape, particularly in the streaming and Connected TV (CTV) environment.

CPM has become a fundamental metric for measuring ad campaign cost-efficiency and optimizing ad spend. As precise audience targeting and advanced ad impression metrics gain prominence in streaming and CTV, the importance of CPM in evaluating campaign effectiveness and driving revenue growth is underscored. Inventory sharing and programmatic strategies further influence CPM rates by factoring in inventory availability, targeting capabilities, and ad space demand.

To learn more, read our previous article, “Understanding CPM in the Streaming and Connected TV (CTV) World: A Comprehensive Guide.”

Where to start and who to reach out to?

Broadpeak monetization solutions are part of an ecosystem that focuses on SSAI. If your area of interest is more specifically focused on a service or a component within the wider scope (e.g. DSP, SSP, Ad Server, Ad Proxy, Ad Ops, Sales House, …), Broadpeak can put you in touch and introduce you to a wide range of Ad Technology partners. Depending on your geography, our local partners can also help you engage in specific markets, as well as the tier-one partners Broadpeak works with globally.

In the next post of this series

In the upcoming parts of this blog series, you will learn about advanced topics such as SSAI 2.0, linear addressable TV, and the intricacies of the Ad Servers and SSP ecosystem. We will highlight innovative technologies and lucrative use cases shaping addressable TV advertising, providing valuable insights for everyone seeking to stay ahead in the digital advertising industry. Stay tuned for more in-depth analysis and practical applications in the subsequent parts of this comprehensive guide.